China has been the factory for the world for over 30 years now. However, manufacturing in China is in transition and the country is moving away from a low cost, low-margin manufacturing model to one of higher end, higher margin, and higher value-add.

Although it is true that the Chinese government has had a significant role to play in triggering this transition, it is naïve to assume that this is exclusively a government-driven revolution. There are other factors are at play here.

Success brings change

The unparalleled success of the manufacturing sector has brought significant changes that cannot be ignored. Any article on sourcing in China must also comment on the social, energy and environmental implications of China’s manufacturing golden years.

Manufacturing has brought a sea change in China’s labour market and the make-up of its population. As China’s economy has expanded, creating opportunities and wealth in many sectors, the middle class has seen a significant expansion, and assembly line jobs are not as attractive as they once were. This has caused managers to raise wages to attract workers, and local governments in industrial centres to steadily increase the mandated minimum wages in a drive to improve the welfare of working families. Net-net result is that labour costs in China are now significantly higher than in many other emerging economies.

In a 2015 study, the Boston Consulting Group said the costs of manufacturing in China’s major export-producing zone were now almost the same as in the United States, after taking into account wages, worker productivity, energy costs and other factors. NY Times

And as workers’ earning power increases and the middle class grows, Chinese are expecting more from their government. They are demanding cleaner air, and the government is not blind to the need as it realises that the existing low-cost and environmentally-questionable manufacturing methods are not sustainable going forward. This has triggered the introduction of new environmental regulations which have seen a reduction in the production capacity of pulp due to the closure of a large number of mills in the north of China and Zhejiang. Further, the move to cleaner energy sources and subsequent increase in energy costs has meant higher over-heads for factory owners.

At the same time, factory owners are more aware of the opportunities that come from the increase in innovation and the production of more high-value products.

It may have been that for the past 20 years the world has been buying finished products from China, and it may have been that Chinese factories have had to import the machines needed to make those products, but this is now no longer the case. Chinese factories have acquired a significant amount of expertise and know-how which is now being used to produce the machines that make the finished products. No longer do they depend on German engineering to bring innovation to the production line.

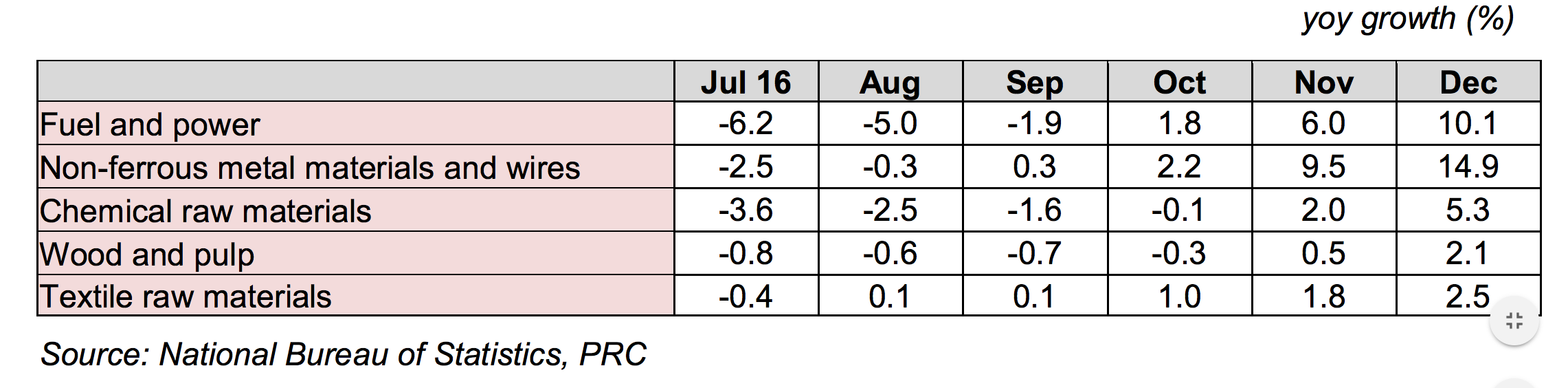

As we have seen, the cost of producing in China is no longer significantly lower than in Western countries. In fact, the major cost component for many suppliers these days is raw materials and other commodities that are to a certain degree outside of China’s control. Fuel and power, chemical raw materials, wood and pulp, textile raw materials, have all seen significant increases year on year.

The packaging industry has felt the impact of such factors. Recycled paper, rigid board, art paper, tin and other packaging supplies have all seen wholesale price increases of up to 50% in the last few years.

China Sourcing 2.0

Companies that continue to base their manufacturing strategies solely on China’s rock-bottom wages […] are in for a rude awakening. New challenges will require new competitive priorities. McKinsey

Many companies will feel extremely tempted to look elsewhere. But this is tantamount to an employer, in seeking savings, sacking his most experienced worker (having invested a significant amount of time and resources to train him to become an expert) and then going out to recruit a less experienced worker!

Ditching China for other markets offering cheaper manufacturing is a seemingly easy escape route, but one full of many imponderables, especially for premium and luxury brands looking to offer unique customer experiences. Today China is leading the way in quality and technology. Chinese infrastructure is also better developed than other markets, ensuring increased delivery reliability and seamless processing.

At Hunter we believe that the big winners in China will be those who really understand the Chinese manufacturing landscape. Whilst we do not profess to have all the answers, we know that we are second-to-none in our understanding of manufacturing efficiency and the factors at play in China.

During the last couple of years, we have been working hard to ensure that our clients remain competitive and profitable. The effort has paid off as we continue to deliver innovative packaging solutions which are helping to negate some of the challenges discussed above.

Our strong partnerships with some of China’s most successful factories mean that Hunter is extremely well placed to drive innovation and work with factory owners to support change, and to ensure a win-win scenario for all parties.

The answer is not to move away from China, but to partner with experienced packaging partners that are well placed to offer their clients innovative packaging solutions whilst optimising manufacturing savings.